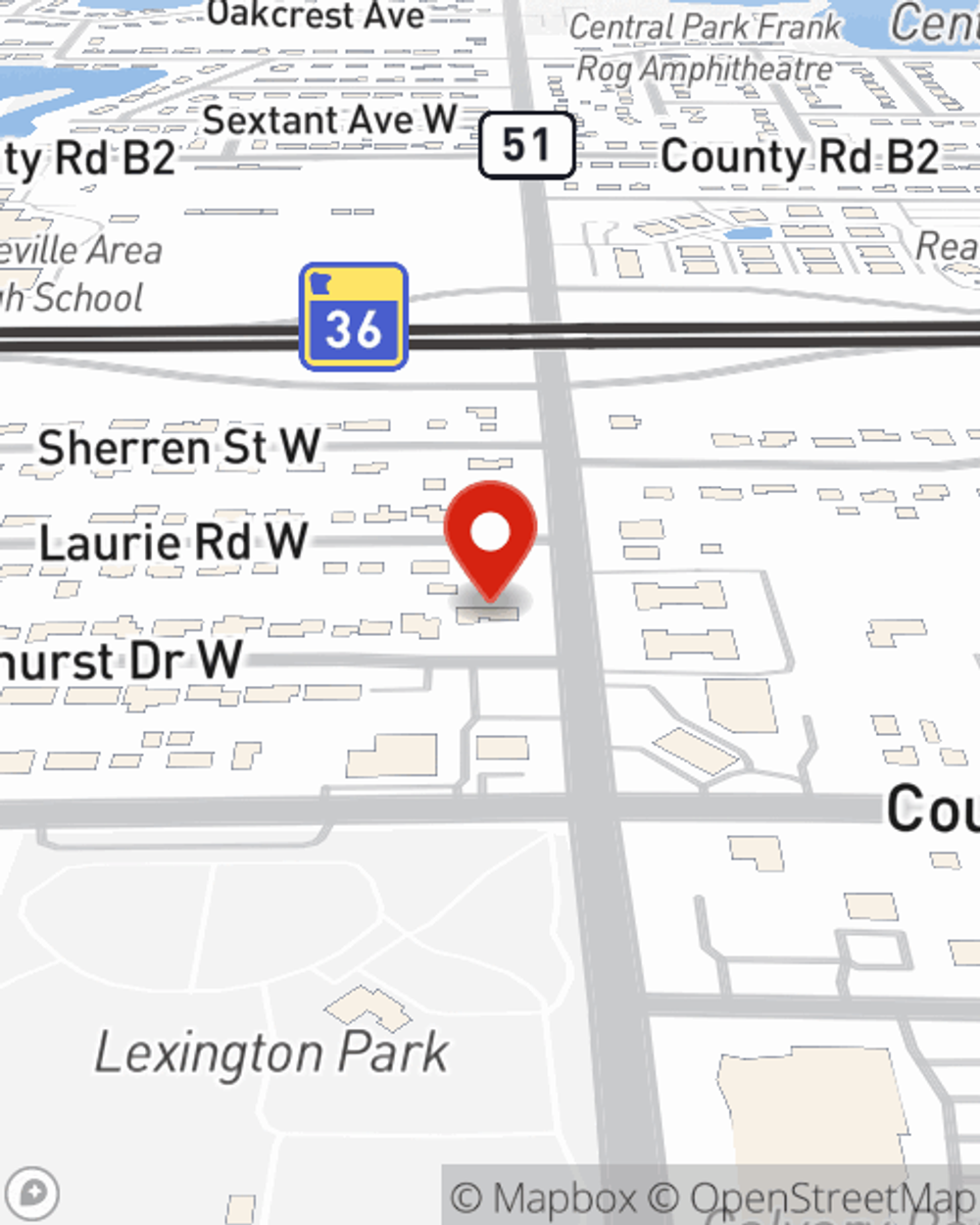

Homeowners Insurance in and around Roseville

Looking for homeowners insurance in Roseville?

Help cover your home

Would you like to create a personalized homeowners quote?

- Roseville

- Minneapolis

- St. Paul

- Shoreview

- arden hills

- Little Canada

- White Bear Lake

- North Oaks

- North St. Paul

- New Brighton

- Vadnais Heights

- Woodbury

- Falcon Heights

- Bloomington

- Maplewood

- Mendota Heights

- Columbia Heights

- Fridley

- West St. Paul

- Inver Grove Heights

- Brooklyn Center

- Richfield

- Robbinsdale

- St Anthony

What's More Important Than A Secure Home?

One of the most important steps you can take for your favorite people is to cover your home through State Farm. This way you can sleep well knowing that your home is taken care of.

Looking for homeowners insurance in Roseville?

Help cover your home

State Farm Can Cover Your Home, Too

From your home to your prized keepsakes, State Farm has insurance coverage that will keep your valuables secure. Chris Ahles would love to help you understand your options.

When your Roseville, MN, home is insured by State Farm, even if life doesn't go right, your most valuable asset may be covered! Call or go online now and see how State Farm agent Chris Ahles can help meet your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Chris at (651) 487-4204 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Chris Ahles

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.